TFSA versus RRSP – What you need to know to make the most of them in 2023

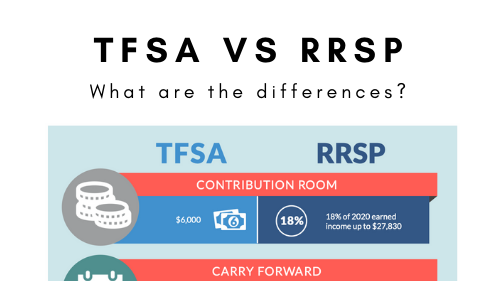

2023, Blog, RRSP, Tax Free Savings AccountWhen looking to save money in a tax-efficient manner, Tax-Free Savings Accounts (TFSA) and Registered Retirement Savings Plans (RRSP) can offer significant tax benefits. The main difference between the two is that TFSAs are ideal for short-term goals, such as saving for a down payment on a house or a vacation, as its growth is entirely tax-free, while RRSPs are more suitable for long-term goals such as retirement. When comparing deposit differences, TFSAs have a limit of $6,500 for the current year, while RRSPs have a limit of 18% of your pre-tax income from the previous year, with a maximum limit of $30,780. In terms of withdrawals, TFSAs have no conversion requirements and withdrawals are tax-free, while RRSPs must be converted to a Registered Retirement Income Fund (RRIF) at age 71 and withdrawals are taxed as income.

2023 Financial Calendar

2023, Blog, Financial Planning, Retirement, RRSP, Tax Free Savings AccountWelcome to our 2023 financial calendar! This calendar is designed to help you keep track of important financial dates and deadlines, such as tax filing and government benefit distribution. You can bookmark this page for easy reference or add these dates to your personal calendar to ensure you don't miss any important financial obligations.

TFSA versus RRSP – What you need to know to make the most of them in 2022

2022, Blog, RRSP, Tax Free Savings AccountTFSAs and RRSPs can be significant savings vehicles. To help you understand their differences, we have put together this article to compare:

- TFSA versus RRSP - Differences in deposits

- TFSA versus RRSP - Differences in withdrawals

Understanding the differences between these two types of tax-advantaged accounts can help you better plan for future purchases and your eventual retirement.

TFSA vs RRSP – What you need to know to make the most of them in 2021

2021, Blog, RRSP, Tax Free Savings AccountBoth TFSAs and RRSPs can be significant savings vehicles for your clients. We've put together an article to help your clients easily understand the differences between them – with one section focussing on differences in deposits and one focussing on differences in withdrawals.

The deposit section focuses on:

• How much contribution room is available each year

• How carry forward works for TFSAs and RRSPs

• Tax deductibility of contributions

• Tax treatment of growth

The withdrawal section focusses on:

• Conversion requirements

• Tax treatment of withdrawals

• Impact of withdrawals on government benefits

• Impact of withdrawals on contribution room

2021 Financial Calendar

2021, Blog, personal finances, RDSP, Registered Education Savings Plan, Retirement, RRSP, tax, Tax Free Savings AccountWe’ve put together a financial calendar for 2021. It contains all the dates you need to know to make the most of your government benefits and investment options. Whether you want to bookmark this or print it out and post it somewhere prominent, you’ll have everything you need to know in one place!

Personal Tax Planning Tips – End of 2020 Tax Year

2020 Only, Blog, Charitable Gifting, Coronavirus, Coronavirus - Associates, Coronavirus - Practice Owners, Coronavirus - Retired, Coronavirus - Retiring, Coronavirus - Students, disability, Disability Insurance, Family, financial advice, Financial Planning, health benefits, pension plan, RDSP, Registered Education Savings Plan, RRSP, tax, Tax Free Savings AccountTo help our clients, we’ve put together a comprehensive article filled with great tips on how to get ready for 2020 tax season. Here’s a summary of our personal tax tips article:

• Details about the different COVID-19 benefits programs and the tax ramifications of them

• Information about family tax issues including the Canada Child Benefits and tips on how to split income.

• Managing investments. Details about contributing to various savings plans such as a TFSA, RESP, or RDSP. Also tips on how and when to donate to charity and how to time the purchase or sale of investments.

• Retirement planning. How to make the most of your RRSP, things to know if you’ve turned 71, and tips on RRIF conversion.